Table of Contents

Introduction

It is 2025, and Debt may become a guest who is unwelcome and does not want to leave. Whether it’s swelling credit card balance, current loans, or sudden medical expenses, the burden of Debt is unbearable in terms of your financial well-being. For a significant number of young adults between 25 and 45 years old, the reality is living in a day-to-day struggle with cash flow, as well as paying off bills and loans, and saving some money.

However, the positive news is that gomyfinance.com debt tools will help you make your way to financial independence. Gomyfinance.com credit will feature user-friendly tools that enable you to manage your Debt, track your estimate, and even boost your credit score.

Consider managing your credit card debt more effectively and gaining control over your financial future. In this end-to-end guide, we are going to give you some practical, ready-to-use strategies, examples that can be applied in the real world, and tips you can take to see how you can achieve financial well-being in twenty-five twenty-five. Want to make the first step? Now, it would be interesting to explore how gomyfinance.com debt management can change your finances.

Understanding the Debt Crisis in 2025

The situation with Debt in 2025 is even more difficult. As a report published by Experian in 2025 has shown, the average American owes more than $6,500 in credit card balance, with student loans averaging $39,000, and medical bills that are on the rise as healthcare costs continue to increase.

Credit rates are also on the rise, with an average of 22 per cent on credit cards, making repayment a nightmare. To young adults, this usually translates to rent, electricity, and loan payments, along with few opportunities to estimate and hardly any time to think about the future.

The psychological strain is equally enormous. Concerns about unpaid bills or accumulating Debt may undermine your financial security, causing stress and anxiety. gomyfinance.com credit is here to help you achieve reliable monetary health, providing the tools to organise your expenses and focus on paying off debts.

With the capabilities of gomyfinance.com credit, you can address these financial issues and regain control, ultimately progressing towards economic certainty. It does not matter whether your Debt lies in credit cards or medical bills; one can inform their decisions and make their personal finance life a little bit easier with the help of the user-friendly platform at gomyfinance.com.

How gomyfinance.com Debt Solutions Work

Exploring gomyfinance.com Credit Approach to Debt

Credit management doesn’t have to be a maze. gomyfinance.com credit management offers a clear path forward, featuring tools such as debt calculators, personalised refund plans, and real-time progress tracking. They are features that suit all categories of people, including those who are just starting in personal finance management and those who have been long-term budgeters.

gomyfinance.com credit can help you visualise your debt settlement plan, understand your credit rates, and make informed decisions. To illustrate, the site gomyfinance.com credit features a refund calculator that allows you to enter your balances, credit rates, or monthly payments to create an individualised debt settlement schedule.

The site clarifies complicated financial information into understandable chunks, allowing you to always handle Debt without feeling intimidated. When you set out to pay off a single credit card balance or multiple loans, gomyfinance.com makes it empowering yet straightforward.

Case Study: Maria’s Journey to a Debt-Free Future

Meet Maria, a 32-year-old Chicago teacher who had to somehow manage her $12,000 credit card debt in 2044. Her minimum payments were like a treadmill that took her nowhere, as they were due at high credit rates of about 20 per cent. She was so irritated that she went to gomyfinance.com to seek assistance.

Maria used a debt settlement plan on gomyfinance.com to settle her credit card debt and identified the card with the most expensive credit rates, where she planned to spend an additional amount to cover the Debt first.

Automation tools helped her avoid missing any payments and saved her credit rating. In just 15 months, Maria paid off her Debt, and her credit score increased by 50 points. Maria says that with the help of gomyfinance.com credit, she felt in charge. Her story highlights how gomyfinance.com debt tools can transform your financial future with practical, measurable results.

Managing Bills with gomyfinance.com Bills Tools

Why gomyfinance.com credit Bills Are Key to Debt Management

Unpaid bills are an unsuspecting debt hole. By 2025, it will become increasingly expensive to cover utilities, subscriptions, and healthcare expenses, and delayed payments may result in penalties or additional fees.

gomyfinance.com credit bill tools will help ensure you don’t fall behind and incur extra expenses due to delayed payments. A combination of the bill and debt-refund processes makes maintaining your financial life easier with the help of gomyfinance.com.

For example, setting up bills with gomyfinance.com credit will enable you to connect your accounts and receive reminders about upcoming payments. This proactive practice would keep your estimate on track, and the chances of failure are diminished. Estimating bills is a crucial step toward achieving debt-free stability.

Clarify Bill Payments for Financial Well-Being

gomyfinance.com offers automation services that facilitate bill payment without inconvenience. You can arrange recurring payments for utilities, rent, or subscriptions, and you will never miss a deadline. The service also categorises your expenditures within your estimate, which helps you manage your funds effectively.

This not only saves time but also helps your finances by organising them. Using bills on gomyfinance.com credit, you will be able to prioritise the money refund without fearing that you might lag behind the refund schedule.

Improve Your Credit Score with gomyfinance.com

A credit score is one of the key building blocks of your credit health. A high level of Debt and delayed payments may reduce it, and as a result, you will be denied access to loans, mortgages, or attractive credit rates. Gomyfinance.com’s credit score tools are the right solution for improving your credit score and tackling Debt, including a comprehensive personal finance solution.

A good example is gomyfinance.com credit, which monitors your payment status and credit-to-debt ratio and provides practical advice on how to achieve higher credit ratings. Small measures, such as timely payment of bills via gomyfinance.com credit at a lower rate than the premium Debt, could go a long way.

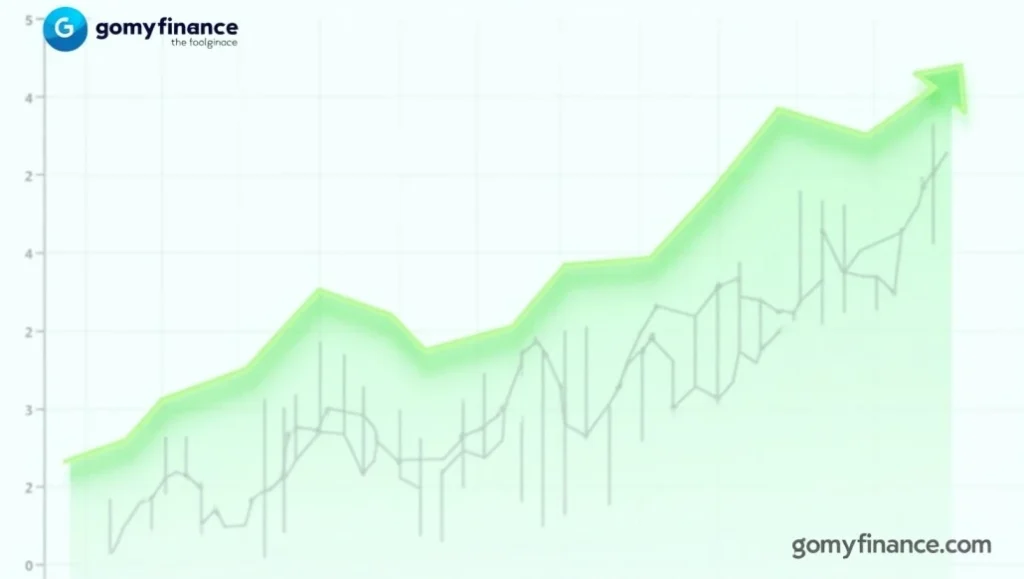

A 2025 TransUnion study predicts that regular and on-time refunds can increase your credit score by up to 30 points over six months. When you use gomyfinance.com credit. You are not only dealing with Debt; you’re also creating a better financial future.

6 Strategies to Manage Debt with gomyfinance.com

Create an estimate for monetary health.

The estimate is the key to successful credit management. The estimate tools offered by gomyfinance.com credit will help you organise your expenses and income, enabling you to cover your necessities, pay your debts, and save money.

Try the 50/30/20 rule: allocate 50% of your income to needs (rent, bills), 30% to wants (dining out, entertainment), and 20% to debt settlement and savings. With the help of gomyfinance.com credit, you can enter your financial data to create a personalised budget that aligns with your financial plans.

To illustrate, one user, who goes by the name Jake, set a budget through gomyfinance.com using his student loan of $8,000 as his priority. Having reduced unnecessary expenditures, he covered a $2,000 balance in six months and was able to create a modest emergency fund. A reasonable budget helps you stay on track and achieve financial health.

Prioritise High-Interest Types of Debt

Not every single Debt is comparable. Premium Debt, such as credit cards with credit rates of 20–25%, grows faster and incurs higher costs over time. gomyfinance.com credit helps you identify these debts and prioritise refunds using strategies such as the debt avalanche method (paying off high-interest Debt first) or the debt snowball method (paying off smaller balances for quick wins).

Its debt calculator indicates the amount of savings that you will incur by pursuing high credit rates. As an example, when you are carrying a $5,000 balance on your credit card at a credit rate of 22%,

gomyfinance.com credit can help you allocate additional funds to make extra payments and pay off your Debt sooner, thereby saving hundreds of dollars in interest. This practice enables you to achieve financial freedom more quickly.

Automate gomyfinance.com Bills and Debt Payments

Busy professionals will appreciate the automation of payments on tools billed at gomyfinance.com, which allows for automatic payment of utilities, credit cards, and more. This ensures that you never miss a due date, thereby avoiding late fees that can negatively impact your credit rating. One can also automate any extra payments for Debt through your budget and automate the debt settlement.

Consider, for example, Sarah, a 28-year-old graphic designer. Automating her monthly credit card bills of $200 using gomyfinance.com enabled her to improve her credit rating by 20 points in three months, as she avoided the risks associated with delayed payment fees. Automation makes your financial regimen easy, and it helps you stick to it.

Negotiate with Creditors Using gomyfinance.com

Did you know that you can negotiate with your creditors to obtain lower credit rates? gomyfinance.com credit offers resources, including script samples and debt-analysis tools, to help you navigate the process. As an example, you could call your credit card company and ask them to reduce your credit rates due to your payment history, potentially saving hundreds of dollars on interest.

In 2025, a NerdWallet study found that 70 percent of individuals who negotiated with their creditors received rate cuts, reductions, or easier terms with their credit. You can enter these discussions freely and pay off Debt more quickly.

Build an Emergency Fund for Saving Money

Sudden bills, such as car repairs or medical expenses, might disrupt your debt refund strategy. An Emergency fund helps keep you debt-free, as it acts as a safety net. gomyfinance.com credit budgeting tools allow you to save as little as $50 per month, and eventually, you will have an emergency fund.

In the long run, this helps you achieve economic and monetary health as well as being debt-free. A case in point, Tom was a user who saved a year’s worth of $1,000 as he repaid his loans with gomyfinance.com credit. His emergency fund helped him shun additional liabilities when his car stalled.

Track Progress with gomyfinance.com.

You will remain motivated by being able to see the Progress. gomyfinance.com credit features tracking tools that enable you to monitor your Progress as you reduce your debts and enhance your credit scores. The feeling of seeing your balances decrease and your financial health improve may keep you motivated.

For example, the gomyfinance.com dashboard allows you to view your timeline to clear off your Debt and celebrate your successes, such as paying off a credit card. This visual feedback enables one to experience the satisfaction of effective credit management and its achievement.

Understanding Different Types of Debt

Debt is not something that fits everyone. The main point to control is knowing various types. Secured Debt, such as mortgages or car loans, is tied to specific assets, while unsecured Debt, like credit cards or medical bills, often carries higher interest rates. gomyfinance.com debt management addresses both, helping you prioritise high-cost debts for faster repayment.

For example, you can classify your debts on gomyfinance.com credit and create a customised repayment plan. Assuming you have a $3,000 credit card balance and a $10,000 car loan, the platform can help provide a recommendation to pay the credit card first, as it has a higher interest rate. This understanding also enables you to make informed decisions and achieve financial health.

Common Mistakes in Credit Management to Avoid

Controlling Debt is a process that has its pitfalls. The first is not to pay attention to your credit score, which can be damaged by delayed payments or excessive credit use. The other is the failure to run a budget, which contributes to overspending and delays in debt repayment. There is also the situation where people take on new Debt to clear their old balance, thus becoming trapped in a cycle.

Gomyfinance.com credit helps you avoid these mistakes. Its finance management tools help you spend money wisely, and gomyfinance.com’s billing system allows you to avoid late payments. Credit scoring on the platform will ensure that you are always aware of the health of your finances and remain prepared to address any issues that may arise.

FAQs About gomyfinance.com Debt and Monetary Health

How Do gomyfinance.com Debt Solutions Simplify Credit Management?

gomyfinance.com offers credit debt solutions, including personalised repayment plans, debt calculators, and tracking tools. These aspects help control Debt quite affordably, allowing you to eliminate it more quickly and improve your monetary health.

Can gomyfinance.com Bills Prevent Debt Buildup?

Yes! gomyfinance.com bills tools automate payments and track due dates, preventing late payments that lead to Debt. This helps maintain your budget and ensures stable finances.

How Does gomyfinance.com Credit Score Improve My Financial Future?

The credit score tools at gomyfinance.com will help you track your payment history and debt levels, providing tips on how to achieve a higher credit score. This would give you access to superior loans and interest rates, which would improve your financial life.

Is gomyfinance.com a Trusted Management Platform?

Certainly, gomyfinance.com credit ensures a high level of data protection through advanced security technology that is trusted by many. Its open error correction in handling of debts means that its monetary health is reliable, much like your own.

How Fast Can I Achieve Financial Stability with gomyfinance?

The schedules may differ, and payments of debts can be accelerated through custom plans offered by gomyfinance. To illustrate the effectiveness of these tools in achieving financial stability, Maria used the 15 months to pay off $ 12,000.

Conclusion

In 2025, escaping Debt is more achievable than ever with gomyfinance.com credit management. Gomyfinance makes personal finance easy with budgeting tools, bill automation, and credit score tracking, among other features, to help you stay in control.

Regardless of whether you are managing debts on a high-interest credit card or trying to build an emergency fund, these resources can assist you and help you achieve financial liberation. Debt is not your enemy. Browse gomyfinance.com today and begin your new quest of becoming debt-free and financially fit by 2025. Your financial well-being is just a click away!

For more Exciting Blogs, Please Visit The Website”thelogicalblogs.com